Economy

Related: About this forumSTOCK MARKET WATCH: Tuesday, 22 April 2025

STOCK MARKET WATCH: Tuesday, 22 April 2025

Previous SMW:

SMW for 21 April 2025

AT THE CLOSING BELL ON 21 April 2025

Dow Jones 38,170.41 -971.82 (2.48%)

S&P 500 5,158.20 -124.50 (2.36%)

Nasdaq 15,870.90 -415.55 (2.55%)

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Market Conditions During Trading Hours:

Google Finance

MarketWatch

Bloomberg

Stocktwits

(click on links for latest updates)

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

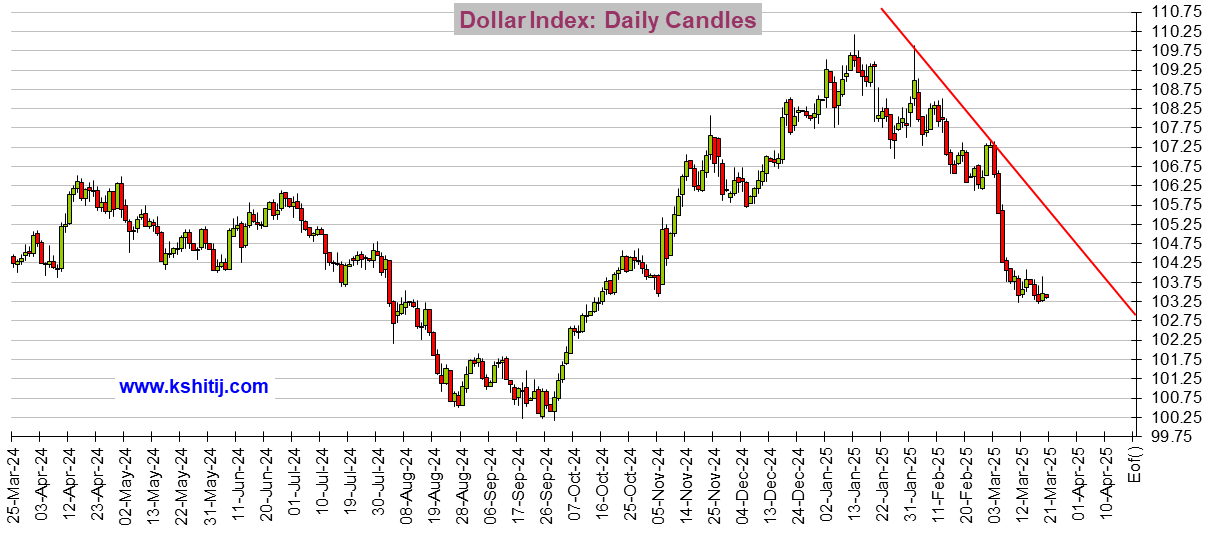

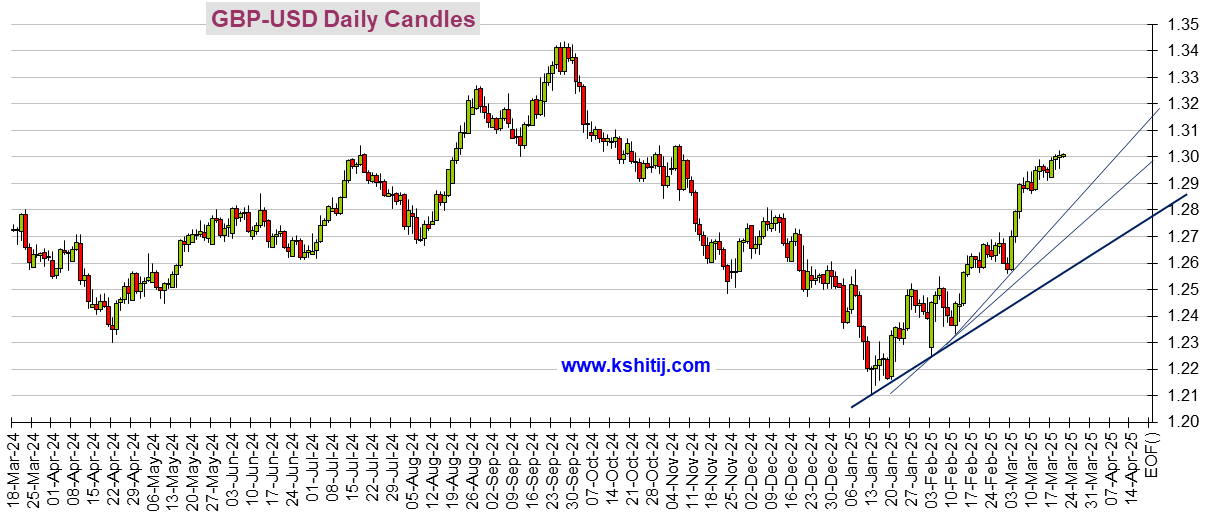

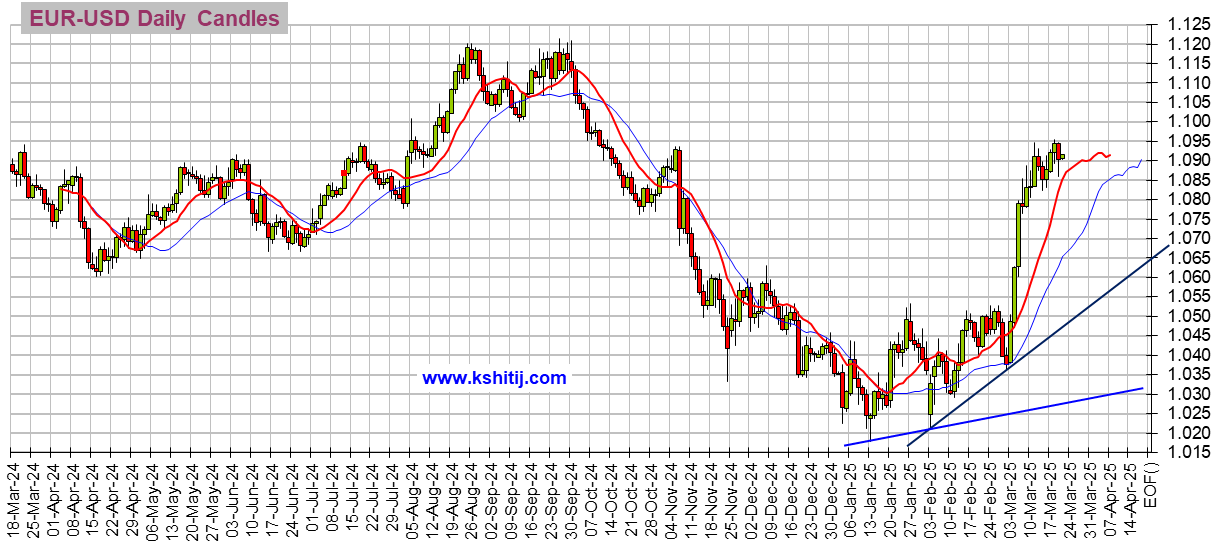

Currencies:

(Awaiting new links)

Gold & Silver:

(Awaiting new links)

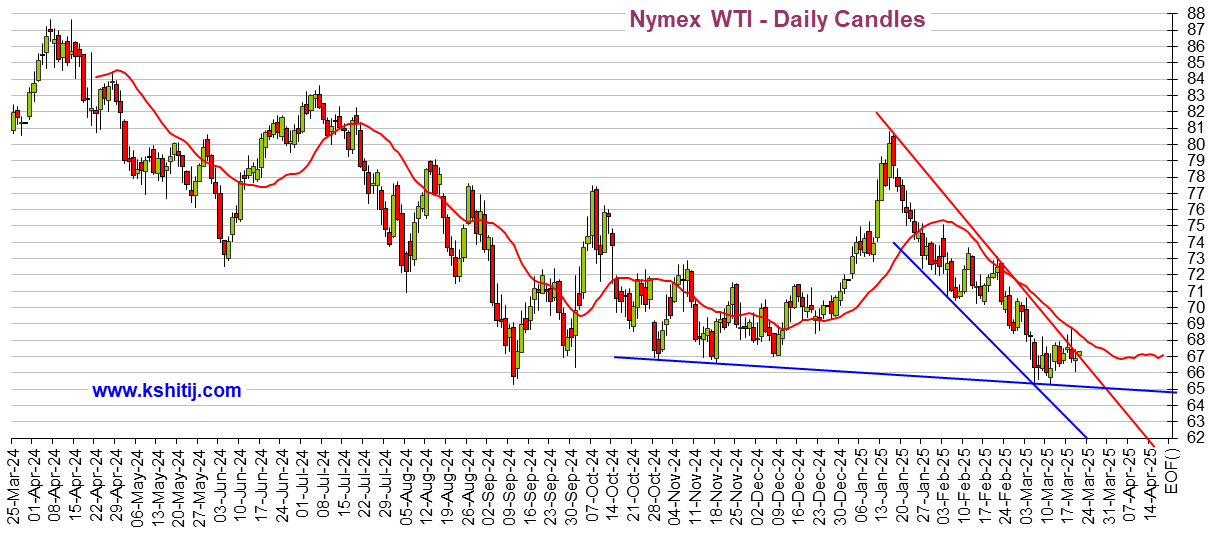

Petroleum:

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

DU Economics Group Contributor Megathreads:

Progree's Economic Statistics (with links!)

mahatmakanejeeves' Rail Safety Megathread

mahatmakanejeeves' Oil Train Safety Megathread

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Quote for the Day:

Farmers across the United States say they could face financial ruin – unless there is a huge taxpayer-funded bailout to compensate for losses generated by Donald Trump’s sweeping cuts and chaotic tariffs.

The Guardian, 15 April 2025

This thread contains opinions and observations. Individuals may post their experiences, inferences and opinions on this thread. However, it should not be construed as advice. It is unethical (and probably illegal) for financial recommendations to be given here.

Lovie777

(20,288 posts)The Dow 30, 30 major companies that some layouts mean little.

Tansy_Gold

(18,167 posts)I never took statistics -- hence a BA instead of a BS in my chosen field -- but it seems the Dow's small sample size doesn't justify its position as The Measure of . . . anything. Yet it's the one most often pointed to with, "See how good (bad) the markets are doing!" It also has bigger numbers, that's supposed to be impressive, I guess.

But if you look at the 30 companies listed on the Dow, very few of them have much to do with any kind of "industrial" manufacturing, and many don't manufacture anything at all. Quite a few seem to be little more than vehicles for transferring/extracting wealth -- American Express, JP Morgan Chase, Visa, Goldman Sachs, UnitedHealth Group, etc. -- from the actual economy via financial services/manipulation.

On the other hand, what do I know? I'm just here to toss out ideas and see what happens. Usually . . . . . . . nothing. ![]()

progree

(12,326 posts)Dow, at least as far as I know. I wish there was one.

I keep track of the S&P 500 stats on a daily basis on the pinned post https://www.democraticunderground.com/111699775

which includes percentage changes from election day, from pre-inauguration day close, from the all-time-high, and year-to-date. (I also have a bottom section on the Dow to make the Dow people happy.)

A couple of stats of interest:

S&P 500 is down 16.0% from it's Feb 19 all time high

Dow is down 15.2% from it's Dec 4 all time high

Neither have reached bear market territory yet, which is 20% down. I expect they both will in days or a few weeks.

Re: another comment -- something like 55% of U.S. households own stocks or stock funds. So while it might not be "the economy", it, and bonds, are the retirement nest eggs for many Americans (along with home ownership). And the stock market is one of the Conference Board's leading economic indicators, as most recessions are preceded by sizable market downturns. When stocks are in a long dive, a lot of people and businesses cut back on their spending and that affects everyone, not just stockholders. Also insurers' assets are reduced, pushing them towards raising premiums. And pension funds are hurt.